Stock markets provide powerful, real-world examples that help students understand how economies grow, fluctuate and respond to global events. By using trading concepts in the classroom, educators can turn economic theory into practical, engaging learning.

Teaching economics is most effective when abstract ideas are connected to real-world behaviour. In the UAE, a country known for rapid development and strong financial ambition, stock market dynamics offer a rich educational tool. When students observe how prices shift and why investors react to different events, they begin to understand economic principles at a deeper level.

Stock trading provides accessible, real-world scenarios that help students link theory to practice. Whether examining supply and demand, investor confidence, monetary policy, or global events, these financial movements illustrate how economic forces interact.

Many UAE educators have found that using examples from the Dubai Financial Market (DFM) or Abu Dhabi Securities Exchange (ADX) helps students understand how local sectors, such as energy, logistics, tourism and technology respond to change. When classroom lessons are grounded in familiar regional contexts, students become more engaged and motivated to explore economic topics.

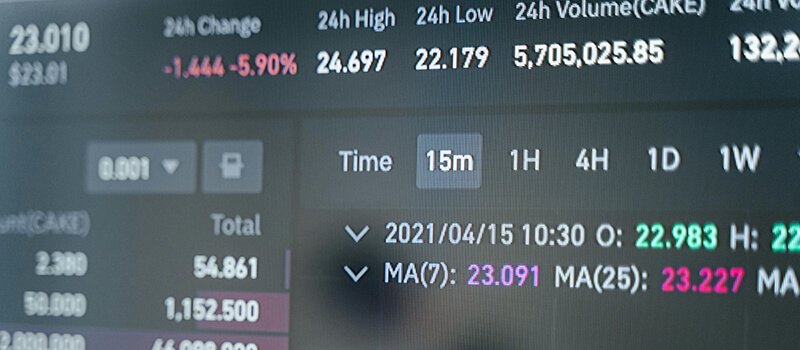

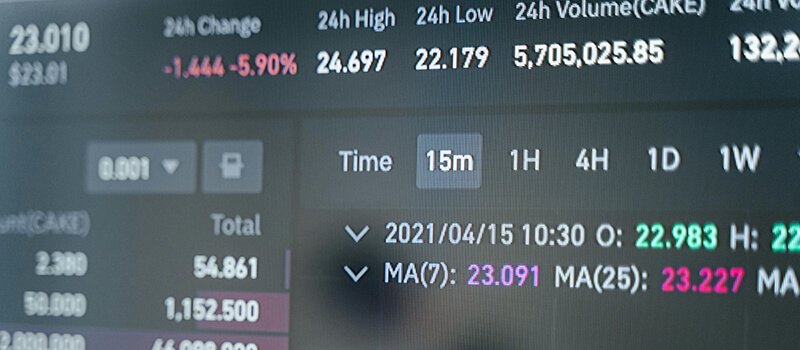

One of the core lessons that you can teach through stock trading is how market sentiment influences price fluctuations. Students often assume that stock prices move purely based on performance, but sentiment, whether optimistic or pessimistic, plays an equally important role. For example, investor reactions to government policy changes, major announcements, or global events can create sudden shifts in market behaviour.

These patterns help educators demonstrate how expectations shape outcomes. Its helpful to introduce the concept of الاسهم as part of understanding how traders evaluate movement and risk within broader economic structures. This allows students to see that stock markets are not random but influenced by identifiable, teachable factors.

The stock market naturally demonstrates the principles of supply and demand. Educators can illustrate equilibrium by showing how stock prices adjust when buying or selling pressure increases. For example, if UAE-based companies announce expansion plans or strong quarterly results, increased demand may push prices higher. On the other hand, if investors anticipate lower profits or external risks, selling pressure may drive prices down.

These movements help students understand how markets reach balance and why shifts in supply and demand occur. Interactive classroom activities, such as simulated trading or chart analysis, allow students to apply these concepts and observe economic theory in action.

Teachers can also use historical UAE market data to highlight how sectors such as energy, banking and logistics have responded to regional and global events. By comparing different periods of economic activity, students can visually track how equilibrium shifts over time, reinforcing the idea that markets behave in patterns rather than in isolation.

The UAE’s dynamic economic landscape offers excellent case studies for teaching market trends. Educators can draw examples from major state-backed companies, renewable energy initiatives, logistics expansions, or tourism growth linked to global events. Analysing companies listed on the DFM or ADX helps students understand how macroeconomic decisions, such as interest rate changes, government investment, or foreign policy developments, affect market confidence.

Moreover, the UAE’s diversified economy provides insight into how different sectors behave during periods of growth or uncertainty. By exploring these real cases, learners gain a clearer sense of how complex systems interact to shape economic outcomes.

Studying stock market behaviour helps students develop practical analytical skills that support academic and professional growth. They learn to interpret charts, evaluate company performance, assess risk and identify patterns. These skills are especially valuable in the UAE, where financial literacy is increasingly encouraged and the economy supports a wide range of investment and entrepreneurial opportunities.

If you integrate these analytical exercises into lessons enable students to build confidence with numbers, trends and strategic thinking. The process of evaluating information, forming hypotheses and reviewing outcomes mirrors the kind of critical thinking central to economics education.

Financial literacy is becoming a priority across the UAE as families, institutions and government-led initiatives encourage young people to understand economic decision-making. Introducing stock trading concepts in the classroom empowers students with knowledge that will benefit them throughout adulthood; whether they pursue business careers or simply want to manage personal finances responsibly.

You can start with the basics: what stocks represent, how markets operate and why diversification matters. Over time, students gain the ability to understand financial news, interpret market trends and recognise the economic forces shaping their environment. This early exposure prepares them for a future in which financial understanding is essential.

Stock trading offers educators a valuable opportunity to translate economic theory into practical, relatable lessons for students in the UAE. By examining real market movements, analysing investor behaviour and exploring how global and local events influence prices, learners develop a clearer understanding of how economies operate.

These insights strengthen analytical thinking and support broader financial literacy goals promoted across the Emirates. When teachers integrate stock market concepts into the classroom, they transform economics from a theoretical subject into a dynamic, real-world discipline that prepares students for informed decision-making in their academic, personal and professional lives.

Add a Comment

Please do not post:

Thank you once again for doing your part to keep Edarabia the most trusted education source.